What is SIP?

A Systematic Investment Plan (SIP), more popularly known as SIP, is a facility offered by mutual funds to the investors to invest in a disciplined manner. SIP facility allows an investor to invest a fixed amount of money at pre-defined intervals in the selected mutual fund scheme. The fixed amount of money can be as low as Rs. 500, while the pre-defined SIP intervals can be on a weekly/monthly/quarterly/semi-annually or annual basis. By taking the SIP route to investments, the investor invests in a time-bound manner without worrying about the market dynamics and stands to benefit in the long-term due to average costing and power of compounding.

Benefits of SIP Investing

Power of Compounding

When you invest regularly through SIP and invest for the long term, the benefits are magnified by the compounding effect. Compounding effect ensures that you earn returns not only on your principal amount (actual investment) but also on the gains on the principal amount i.e. your money grows over time as the money you invest earns returns. And the returns also earn returns.

Power of Starting early

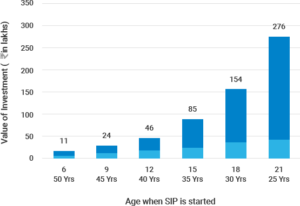

The earlier one starts saving and investing regularly, the easier it is to achieve your goals. The graph below shows the impact of beginning to invest Rs.5,000 monthly at various stages of life till the age of 60 years (assuming a return of 12% p.a.).

Zero on Delivery & Max. Rs. 20 per order in All trade:For opening paperless Account Click Here

Comments